Credit Score

Why should you care?

“You credit score significantly affects your financial flexibility and overall cost of borrowing.”

EW, what the fuck does that mean?

A good credit score = lower interest rates on loans, increases your chance of loan approval, better credit card offers, easier approval when renting, and blah blah blah.

In other words, if you live in America, it’s important. And it’s easy. So just do it.

Don't overthink it as some monstrous task. If you do feel that way, then don't be embarrassed to text me and we can hop on a call and I can help you.

I learned most of what I know from Zachary Burr Abel, a hot actor that now makings his living off of teaching this subject on his website, Monkey Miles.

Here are the things you should know…

CREDIT REPORT vs CREDIT SCORE

Your Credit Report is a detailed record of your credit usage over the last 7 to 10 years.

God, why are they so obsessed with us?

Three main bureaus compile these reports—Equifax, TransUnion, and Experian.

Each (may) hold slightly different data due to the lack of a unified reporting requirement (fucking weird that there aren’t any laws that require creditors to report information to any, or all, of the bureaus). THUS, monitoring all three is crucial for identifying potential discrepancies, fraud, or overlooked debts that could impact your score (ex: forgot to pay a co-pay to a doctor and now your credit score in the trash).

I know that sounds intimidating.

How do I monitor THREE different reports?

Annually, you can get a free credit report from each bureau through annualcreditreport.com as of February 2024. This enables you to scrutinize (or just browse) your report for inaccuracies or signs of identity theft.

It takes 5 minutes, once a year. Be like Nike, and just do it.

If I have a credit report, why do I need a credit score? You need a credit score simply...to make things easier.

FICO figured out how to condense all the information in your credit report into a snapshot, and that score impacts almost anything you'll end up doing that involves borrowing money.

FICO scores range from 300 to 850:

800 to 850: Excellent

You won't be getting better rates than those with 750 scores, but you can brag to your friends

740 to 799: Very Good

Anything over 750 means you're getting the best rates available

670 to 739: Acceptable to Good

Lenders will more or less extend credit to you, but your rates won't be the best.

300 to 669: Very Poor to Fair

You need to read this book and prioritize getting your shit together. Again, I can help you. Text me.

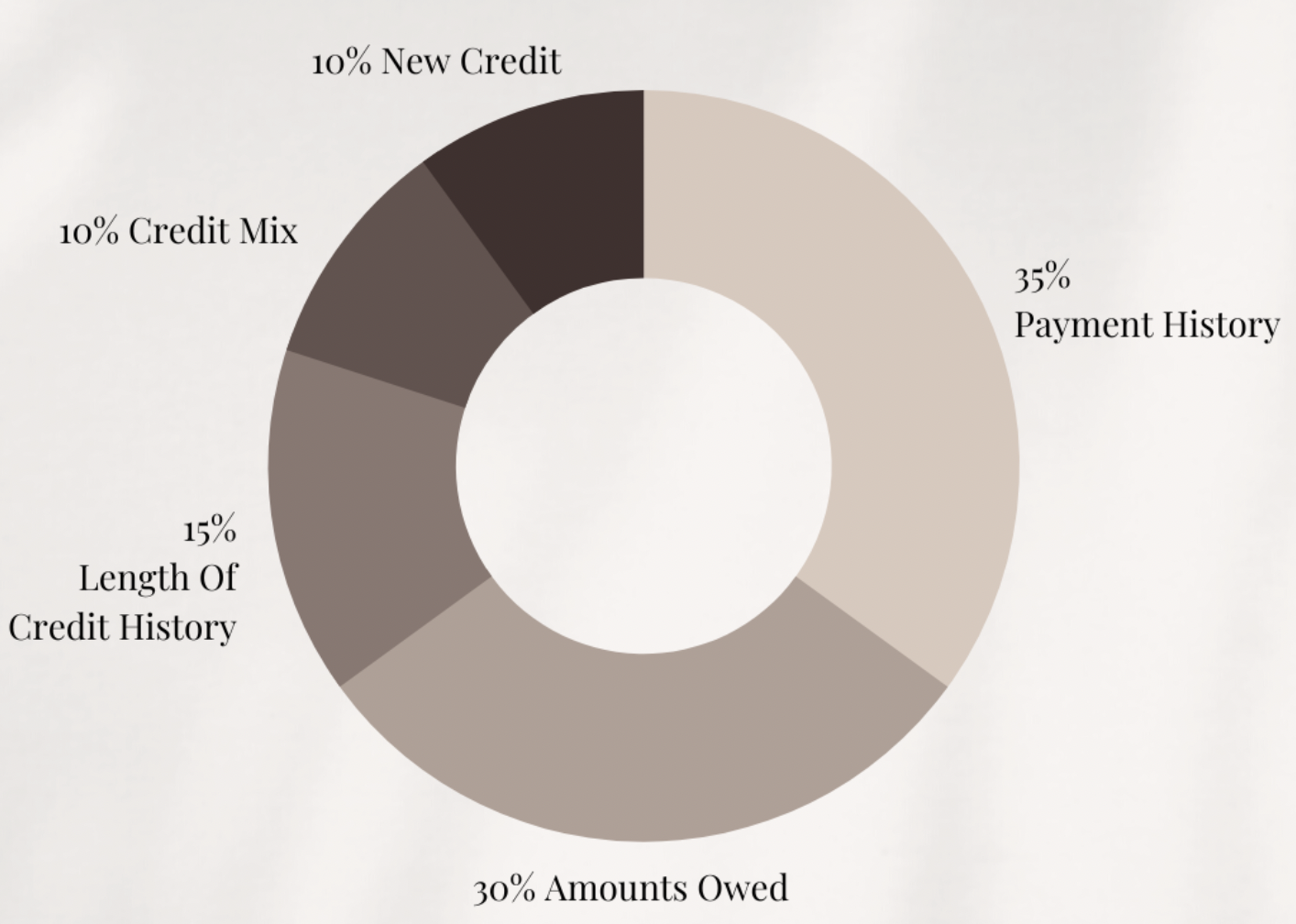

What impacts your credit score? Let’s break down this image and explain how to increase each one.

click the + for more information

-

The most important factor...just pay off your credit card every month on-time

-

Aim for under 10% utilization (on overall credit) even though "experts" say 30%.

Wait what?

It's about how much credit you're using versus what's available.

Example: If you have 3 credit cards, each with a credit limit of $5,000, your total available credit amounts to $15,000. To maintain a utilization rate of 10%, you should aim to spend no more than $1,500 across all these credit cards combined every month.

Strategies to manage utilization include

Adding new credit lines aka open new cards to increase your total available credit

Requesting credit line increases by calling and giving puppy dog eyes over the phone

Making partial payments before statement closure to maintain low utilization percentages.

Is #3 confusing? Let me explain…

This is a bit sketchy, but you can pay a portion of your bill before the statement closes which will reduce the reported balance.

For example, let’s say you spent $2,000 across all three cards. Before the due date, you pay $500 of it so that when the statement closes, it ends at $1,500, which is the 10% utilization we’re looking for.

“Beware” of paying off your card too frequently before the statement closes, as it may raise suspicion of credit card cycling, which is a controversial topic.

-

This is confusing cause it’s not actually the “length” of credit history, but the average of it.

In the words, don’t E V E R close old credit card accounts.

If you're looking to bump up the age of your credit history, just give mom and dad a call and ask them to let you piggyback on their ancient credit card as an authorized user. That old card of theirs will help beef up your credit history.

-

aka Types of Credit: Diversifying your credit types can benefit your score.

-

Opening multiple credit lines within a short period can temporarily lower your score, but this usually rebounds within a few months. Plus, in the long run, it will improve your score as your utilization ratio decreases.

New Inquiries: Anytime there is a hard pull on your credit report, it counts as an inquiry. A hard pull may be done for a new apartment, mobile line, utilities for your house, cable/internet accounts, or credit cards. Inquiries stay on your credit report for 2 years.

Make sense? I know, I know… I’m ambivalent about being an adult and having to deal with this shit, too.

Now, let’s quickly make sure we’re on the same page…

The essence of managing your credit cards effectively boils down to three principles:

ALWAYS pay your balance in full before the deadline/statement closure.

Choose credit cards that offer rewards exceeding the cost of their annual fees.

To make you feel better, listen to this dumb ass shit: When I first got my $500 Chase Reserve credit card, I thought it was a one time fee…I didn’t realize it was an annual fee. It’s fine, it’s fine, everything is fine. Luckily, I get $300 of travel credit plus some other shit so it seems worth it to have this card.

Opt for credit cards that accumulate points beneficial to your financial aspirations, be it through cashback or travel rewards.

Here’s a good resource comparing credit cards if you want help picking the one that’s right for you.

If you want an in-depth understanding of credit score and how your credit cards impact this, then read "First Class Travel on a Budget: How to Hack Your Credit Cards to Book Incredible Trips for Less". Amazon has a nice sample section of this book.

Cheers,

M

PS: Liability Shit: Please note that while I strive to provide valuable insights and tips on managing finances, I am not a licensed financial advisor or a certified financial planner. The information presented in this blog is for educational and informational purposes only and should not be considered as financial advice. I encourage readers to consult with a qualified professional for advice on personal finance issues and decisions. The strategies and suggestions shared on this blog are based on my personal experiences and research; they may not be suitable for everyone. By using the information provided here, you agree to do so at your own risk and acknowledge that I cannot be held liable for any actions you take based on the content of this blog.